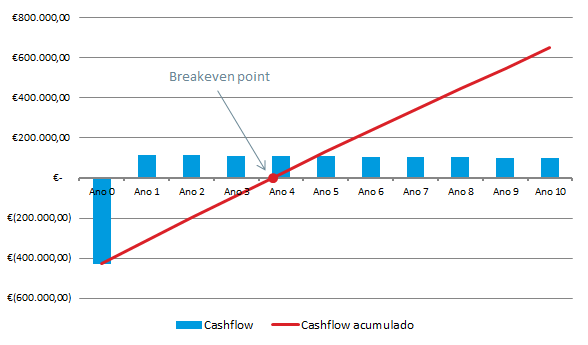

Improving energy performance in a facility requires a financial investment in new technologies, together with the introduction of best practices and socially responsible behaviours to induce savings in energy consumption. The savings generated each month will amortize the investment to achieve the breakeven point that determines the moment of total return of the investment.

The payback or investment return period is one of the key metrics used by entities to make decisions about their investments. At Arquiled we offer consulting and investment return studies.